A Deep Dive into Positional Spending Trends in the NFL

The past five years have brought about several key changes as to how NFL teams allocate money to each position

Introduction & Methodology

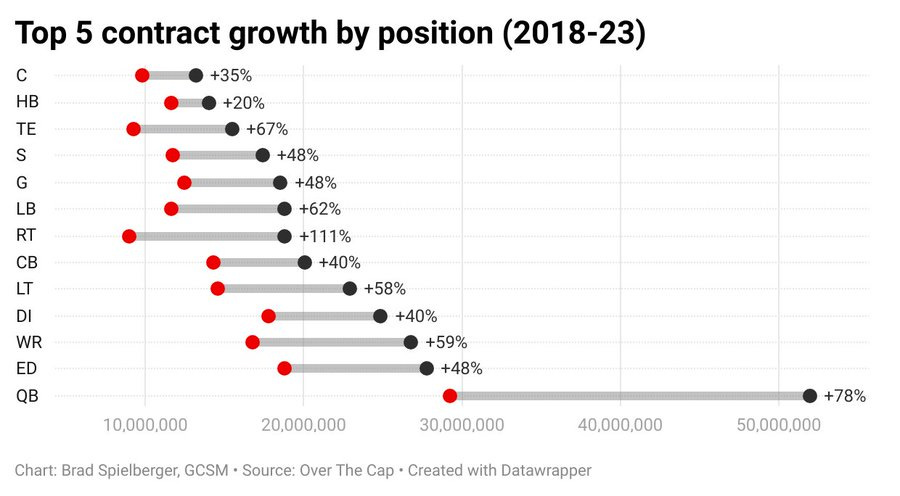

I recently came across some research on Twitter/X from Brad Spielberger of Grand Central Sports Management and TexansCap from OverTheCap and Cap & Trade about how spending at each position has grown over the past few years. Spielberger’s chart is pictured below:

It was very informative and tells a lot about changes in the ways that the NFL values players at each position. I wanted to expand on their research and further analyze trends in positional spending – namely whether the rate at which spending is increasing is changing over time.

To do so, I pulled the 10 highest paid players at each position, as defined by Average Annual Value (AAV), from every season between 2019 and 2024 (data courtesy of Spotrac). I then calculated the average AAV of the highest paid player, the 2nd-5th highest paid players, and the 6th-10th highest paid players in each season during that time.

I then used that data to calculate the 5-year and 3-year Compounded Annual Growth Rate (CAGR), as well as the 1-year growth rate for salaries in each of those buckets at every position. Using CAGR instead of raw growth rates makes it easier to identify changes in spending trends over time.

Analysis

Top AAV

The above chart shows the 5-year CAGR, 3-year CAGR, and 1-year growth rate of the salary paid to the highest-paid player at every position in the NFL. The grey line represents those same metrics for the Salary Cap.

A few trends stand out. Firstly, the top salaries at Wide Receiver and Right Tackle are increasing at an accelerating rate. This was capped off by the extensions given to Minnesota Vikings WR Justin Jefferson and Detroit Lions RT Penei Sewell this offseason. The increased spend on RTs is particularly interesting since it comes at a time when the top Left Tackle, long considered the more important Tackle position, salaries have stagnated.

Secondly, at Quarterback, Edge Rusher, and Interior Defensive Line we may have at least temporarily seen a ceiling established for pay at the position, after several years of modest growth. The same holds true at Tight End, where growth in contract value has largely stagnated since Darren Waller signed a $17M/year deal with the Las Vegas Raiders in 2022. The extension that Travis Kelce signed with the Kansas City Chiefs this offseason seemed as if it were designed to make him the highest paid TE in NFL history, but the actual AAV only slightly surpassed that of Waller’s 2022 deal. Should Dallas Cowboys QB Dak Prescott hit Unrestricted Free Agency next year, he might become the highest paid QB in the NFL, which might set off further growth in top QB salaries.

At some of the “non-premium” positions, we did see Running Back value rebound some this off-season, but Center and Off-Ball Linebacker salaries have stagnated or even fell. The top Safety salary has grown nicely, nearly outpacing the growth of the Salary Cap, all while the top Cornerback salary has stagnated.

AAV 2-5

The above chart shows the 5-year CAGR, 3-year CAGR, and 1-year growth rate of the average salary paid to the 2nd-5th highest player at every position in the NFL. The grey line represents those same metrics for the Salary Cap.

What immediately pops off the page is the growth of WR and QB contracts. And with players like Miami Dolphins QB Tua Tagovailoa, Green Bay Packers QB Jordan Love, San Francisco 49ers WR Brandon Aiyuk, and Cincinnati Bengals WR Ja’Marr Chase (among others) set to receive extensions in the next year, it is likely that the size of contracts at those positions will only continue to increase.

Another interesting trend is that spend on Guards and RTs is increasing, while teams are paying less for LTs. This is perhaps an indication that teams are placing more importance on building a quality Offensive Line, as opposed to just having a quality LT.

Outside Safety, the spend on non-premium positions such as RB, TE, C, and LB is either stagnating or declining. In a Salary Cap league, a dollar that goes to a certain player cannot go to another. The spending trends at these positions is perhaps an indication that NFL teams are better allocating their dollars to more impact positions.

Rounding out the premium positions on Defense, we notably see spend on Interior Defensive Lineman growing faster than for Edge Rushers. Meanwhile, CB salary growth has slowed over the past five years and stagnated this offseason.

AAV 6-10

The above chart shows the 5-year CAGR, 3-year CAGR, and 1-year growth rate of the average salary paid to the 2nd-5th highest player at every position in the NFL. The grey line represents those same metrics for the Salary Cap.

Again, we see QB and WR contract growth accelerate, which will be even more apparent once the Love and Tagovailoa deals are done. But what also stands out is the rate at which G and RT pay is increasing, even as we move down market. This is all happening as we are potentially beginning to see a contraction in the LT market. The modest contracts that the Arizona Cardinals’ Jonah Williams and New York Jets’ Tyron Smith signed this off-season in Unrestricted Free Agency – especially as Gs and RTs got paid handsomely – is another data point to support the significant cooling of the LT market.

Dollars paid out to players at non-premium positions (outside Guard) have dried up as we move down market. Average contract value for the 6th-10th ranked players at RB, TE, C, and S have shrunk over the past five years, and it has stagnated for LBs.

Lastly, the trends that we saw at IDL, ED, and CB amongst players that are among the five highest paid players at their positions held true for those ranked 6-10 in AAV.

Conclusions

Overall, the analysis of positional spending trends in the NFL reveals several key insights that reflect both strategic shifts and economic realities in the league.

Wide Receiver Market Explosion

WRs are emerging as the second most valued position in the NFL, following QBs. This is evident in the accelerating growth rate of WR pay, which is outpacing many other positions. It is likely WRs will have the 2nd highest average salary behind QBs by the end of the offseason, at least when considering the top-5 or 10 players at a given position.

This trend suggests that teams increasingly view elite WRs as pivotal to their offensive success, particularly in a passing-oriented league. Pairing a top WR with at least a solid QB can significantly elevate a team’s performance. Apart from the Chiefs, most the top teams in the league have a bona fide WR1

More Balanced Offensive Line Pay

There’s a notable shift in spending towards Guards and Right Tackles, while Left Tackle salaries have stagnated. This indicates a broader focus on building a cohesive and robust offensive line rather than prioritizing the traditionally more valued LT position.

This likely reflects the need for balanced pass protection across the line. As pass rushers get better and line up all over the Front 7, teams seem to recognize the importance of a strong interior line and protection from both edges. This in turn is driving up the valuation of RTs and Gs and bringing their salaries closer to what LTs make.

Increased Value on Interior Pass Rushers

Spending trends show increased investment that pay for Interior Defensive Linemen is growing faster than that of Edge Rushers.

This is likely a reflection of teams wanting to generate pass rush from more than just the edge. Furthermore, there is a scarcity of IDLs with pass rushing prowess relative to Edge Rushers which is driving up the price.

Diverging Markets in the Secondary

Pay at Cornerback, traditionally a premium position, has remained flat over the past few years while Safety salaries have grown.

The trend with CBs is perhaps an indication of skepticism about the impact a single player at the position can have on the game, especially if the rest of the secondary is weak. Meanwhile, as a response to the increasingly pass-friendly modern NFL, teams have moved towards playing two high Safeties. Given their importance in defending against the deep ball in this alignment, it is understandable that teams are starting to value them more.

Non-Premium Position Squeeze

Salaries for Running Backs, Tight Ends, Centers, and Off-Ball Linebackers have generally stagnated or even declined. This indicates that these positions have become devalued in today’s NFL. This is justifiable as the budgetary constraints of the Salary Cap force teams to prioritize spending on positions deemed more critical to success.

However, the stagnation in TE salaries may also be influenced by a lack of emerging star talent in recent years. The market could shift if young players like the Detroit Lions’ Sam LaPorta and Atlanta Falcons’ Kyle Pitts develop into elite threats, potentially re-energizing the demand for top-tier TEs.

Takeaways

Understanding these spending trends is crucial for NFL teams as they navigate contract negotiations and the NFL Draft. I believe these spending trends unlock a few actionable insights that can help build better teams:

Contract Negotiations at Premium Positions

Teams should consider securing contracts with QBs, WRs, and IDLs sooner rather than later. Given the current hot market for these positions, early deals could save significant money as the cost of subsequent contracts continues to rise.

For example, the Jacksonville Jaguars' proactive extension for QB Trevor Lawrence likely ensured that the Jags got a better deal than the Packers will with Love or Dolphins with Tagovailoa when they sign.

Conversely, teams negotiating with LTs and CBs might adopt a more conservative approach. Given the stagnation in these markets, there's less pressure to act quickly, and teams might benefit from holding firm or exploring more flexible contract terms.

Draft Strategy Adjustments

With the increasing costs of Guards and RTs, teams should be prepared to prioritize these positions higher in the Draft as they look to build stalwart Offensive Lines. Additionally, the high cost of acquiring WRs suggests that teams might consider adopting a strategy like the Green Bay Packers, frequently drafting WRs on Day 2 or early Day 3 to maintain a cost-effective talent pipeline at the position. Green Bay’s entire WR room is poised to cost less than $12M in 2024; less than half the cost of a veteran WR1.

Conversely, the reduced cost for acquiring CBs and non-top-tier LTs could allow teams to draft these players later than in years prior. This then frees up valuable 1st or early 2nd round draft capital to use on players at positions like WR, IDL, or ED where the cost of acquiring veterans is already higher and continuing to grow.

Final Thoughts

In conclusion, understanding and anticipating positional spending trends is crucial for NFL teams looking to gain a competitive edge. By recognizing which positions are experiencing rapid salary growth, teams can make smarter decisions in both contract negotiations and draft strategies. Embracing these insights will help teams not only manage their Salary Cap more effectively but also build balanced, high-performing rosters. As the league continues to evolve, staying ahead of these trends will be key for any team aiming to maintain a successful and sustainable franchise.

Appendix

A.

B.

C.